does instacart take taxes out of paycheck

By writing off expenses that deals with your driving service you can lower your taxable income and pay less taxes. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

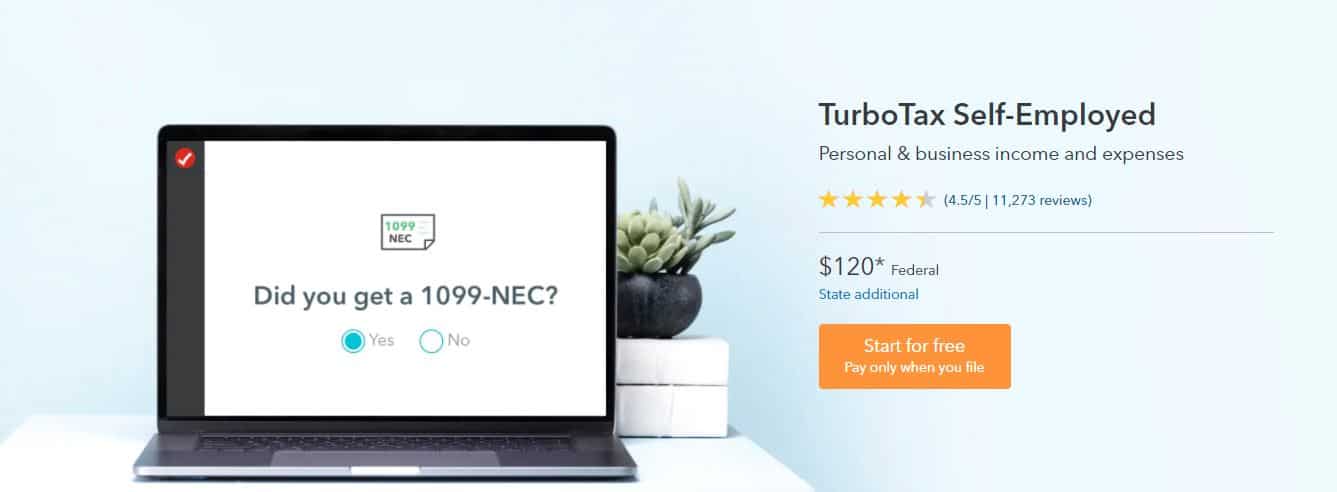

Its a completely done-for-you solution that will help you track and.

. To make saving for taxes easier consider saving 25 to 30 of every payment and. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Instacart shoppers are contractors so the company will not deduct taxes from your paycheck.

Tax Deductions You Can Claim As An Instacart Driver Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099 earnings. What Is Tax Liabilities On W2 Hourly Earnings For Instacart Shoppers In-Store Shopper Hourly Earnings. Heres how it works.

You do get to take off the 50 er portion of the se tax as an adjustment on line 27 of the 1040. I worked for Instacart for 5 months in 2017. That means youd only pay income tax on 80 of your profits.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier. For most Shipt and Instacart shoppers you get a.

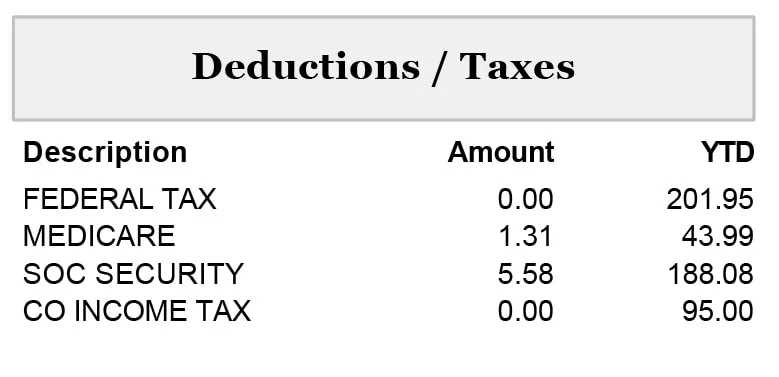

Also known as FICA tax its how freelancers and independent contractors contribute to Social Security and Medicare. So for every thousand dollars you earn the government gets 124 for Social Security and 29 for Medicare totalling 153. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account.

Full-service shoppers pay depends on the order. Estimate what you think your income will be and multiply by the various tax rates. If you pay attention you might have noticed they dont take that much out of your paycheck.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction.

You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. Furthermore How do you get a job with Instacart. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Plan ahead to avoid a surprise tax bill when tax season comes. So you get social security credit for it when you retire.

If you have another part time job and also get a W-2 youll want to check out our guide here. Even if you incorporate and put yourself on payroll if you own more than 2 of the business you cannot claim yourself as an employee. Does Instacart take out taxes for its employees.

You do not submit payroll taxes and dont run an actual payroll. Instacart does not take out taxes for independent contractors. You dont get the QBI.

To pay your taxes youll generally need to make quarterly tax payments estimated taxes. Tax withholding depends on whether you are classified as an employee or an independent contractor. The amount they pay is matched by their employer.

Most people know to file and pay their taxes by April 15th. For example you can deduct the cost of using your vehicle for business by claiming actual expenses or using the standard mileage deduction. For its full-service shoppers Instacart doesnt take out taxes from paychecks.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Does Instacart take out taxes for its employees. Instacart provides an estimate of potential earnings for every order and guarantees shoppers will earn at least 5 for each delivery-only batch and 7 to 10 for each full-service shop and deliver batch.

However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. You pay 153 SE tax on 9235 of your Net Profit greater than 400. A third is too much if instacart is your only income.

Independent contractors can claim business expenses to reduce their taxable income. Especially considering deductions I save 150 a month and should make around 15000 this year. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour.

Social Security tax is 124 of your pay. Except despite everything you have to put aside a portion of the cash you make every week to cover them. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

Because instacart shoppers are contractors the company will not take taxes out of your paycheck. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. Save up about a third for taxes its high for independent contractors.

This is a standard tax form for contract workers. W-2 employees also have to pay FICA taxes to the tune of 765. You pay 153 se tax on 9235 of your net profit.

If youre an Instacart shopper youre self-employedand that means you likely owe quarterly taxes. Medicare is 29 of your pay. Unlike in-store shoppers Instacart delivery drivers have to pay self-employment tax.

Because instacart shoppers are contractors the company will not take taxes out of your paycheck. Instacart shoppers use a preloaded payment card when they check out with a. Thankfully you wont need to pay taxes on everything you earn from Instacart.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. Our analysis of more than 1400 samples of pay data provided by instacart workers across the country finds that the average instacart worker is paid just 766hour after accounting for the costs of mileage and additional payroll taxes borne by independent contractors. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

The estimated rate accounts for Fed payroll and income taxes. Instead full-service shoppers are considered contract workers and they must file a 1099 form with the IRS during tax season. There are a few different taxes involved when you place an order.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

When Does Instacart Pay Me A Contracted Employee S Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Pay Stub How To Get One Other Common Faqs

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me A Contracted Employee S Guide

Self Employment Tax Grubhub Doordash Instacart Uber Eats

How Much Can You Make A Week With Instacart 2022 Real Earnings

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Amazon Take Taxes Out Of A Paycheck Quora

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com