nd sales tax permit

DIf no tax ID number enter one of the following. Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United StatesSales tax is governed at the state level and no national general sales tax exists.

Sales Use Tax South Dakota Department Of Revenue

Regulators are leaning toward torpedoing the Activision Blizzard deal.

. If you filed Form ND-EZ the Filing Status is shown on Page 1 just below your name and address information in Section A circles 1 through 5. Streamlined Sales and Use Tax Agreement Certificate of Exemption E-595E This is a multi-state form. Applications are due before June 1 following the year for which the refund is claimed.

To find a specific form use the search boxes to enter the name of the form select the tax type choose the tax year or include the forms SFN. Licensed direct shippers are required to file reports annually with the Office of State Tax Commissioner. Remote Seller Sales Tax.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Form 307 North Dakota Transmittal of Wage and Tax Statement needs to be submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically even if you did not have employees for the filing period. Federal government websites often end in gov or mil.

The seller may be required to provide. Form 307 North Dakota Transmittal of Wage and Tax Statement Form W-2 and any Forms 1099 that. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a.

Who should use this form. The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. Below are lists of the top 10 contributors to committees that have raised at least 1000000 and are primarily formed to support or oppose a state ballot measure or a candidate for state office in the November 2022 general election.

Follow Jamaican news online for free and stay informed on whats happening in the Caribbean. Refund Amount If you filed Form ND-1 the Refund Amount is found on page 2 line 32. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries. The Tax Commissioner determines the oil trigger price for each calendar year. The expansion of the Child Tax Credit was made for just one year and will be reduced back to 2000 per child in 2023.

Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts. Schedule G is the report for beer direct shippers and Schedule H is the report for liquor. Direct shippers are required to have a North Dakota sales and use tax permit.

The place to start is your states revenue department. Find a Form Find A Form. Renters Refund Tax Application to the Office of State Tax Commissioner.

RegisterChange a Permit Register or Change a Sales Tax Permit. The Application for Senior Citizens or Permanently and Totally Disabled Renters Property Tax Refund is available mid-January through May 31 of each year. The gov means its official.

File a Canadian Refund File a Canadian Refund. To apply for the Renters Refund submit. Not all states allow all exemptions listed on this form.

Oct 6 Los Angeles County gas prices break high record set in June. Send the completed form to the seller and keep a copy for your records. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Forms are listed below by tax type in the current tax year. Recipients of North Dakota tax incentives and exemptions must remain compliant with all state and local tax responsibilities and tax liens owed to the state or a political subdivision. If you filed Form ND-EZ the Refund Amount is found on Page 1 line 6.

Request a Payment Plan Request a Payment Plan. In most states getting the permit is free though some charge a fee. Sales Tax Permit.

FEIN EDriver s License NumberState Issued ID number FForeign diplomat number GName of seller from whom you are purchasing leasing or renting HSellers address Zip code H Agricultural Production I Industrial productionmanufacturing J Direct pay permit K Direct Mail. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. Breaking news from the premier Jamaican newspaper the Jamaica Observer.

Forms Library Over 480000 individual income tax returns were filed in North Dakota for tax year 2020. To find tax forms for the current and previous tax years visit our Forms Library where you can search by form name tax type tax year and SFN. Registered users will be able to file and remit their sales taxes using a web-based PC program.

If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. The lists do not show all contributions to every state ballot measure or each independent expenditure committee formed to support or. The One Time Remittance form is for one-time sales and use tax remittance only.

J Direct pay permit K Direct Mail L Other SODLQ M Educational Organization SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. S Corp Partnership Tax. Watch full episodes specials and documentaries with National Geographic TV channel online.

45 states the District of Columbia the territories of Puerto Rico and Guam impose general sales taxes that apply to the sale or lease of most goods and some services and states also may. If the average price of a barrel of crude oil exceeds the trigger price for each month for three months in a row then the rate of tax on oil extracted from all taxable wells is 6 of the gross value at the well of the oil extracted. A taxpayer may be required to obtain a Property Tax Clearance Statement before claiming a North Dakota tax incentive.

The application for a direct shipping license is available at ND TAP. North Dakota residents to pay use tax on goods purchased tax free from out-of-state sellers. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK.

Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. All businesses that sell taxable goods and services must have a sales tax permit sometimes called a certificate. Before sharing sensitive information make sure youre on a federal government site.

How To Register For A Sales Tax Permit Taxjar

What Are Sales Tax Permits Does Your Business Need One

What Small Business Owners Need To Know About Sales Tax

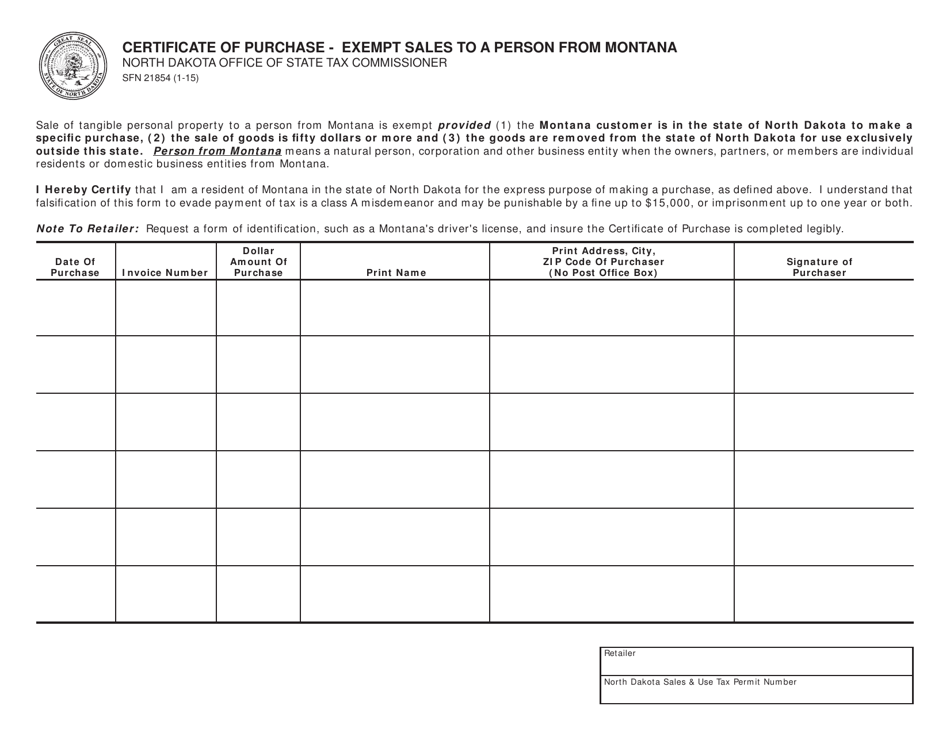

Form Sfn21854 Download Fillable Pdf Or Fill Online Certificate Of Purchase Exempt Sales To A Person From Montana North Dakota Templateroller

Sales Taxes In The United States Wikipedia

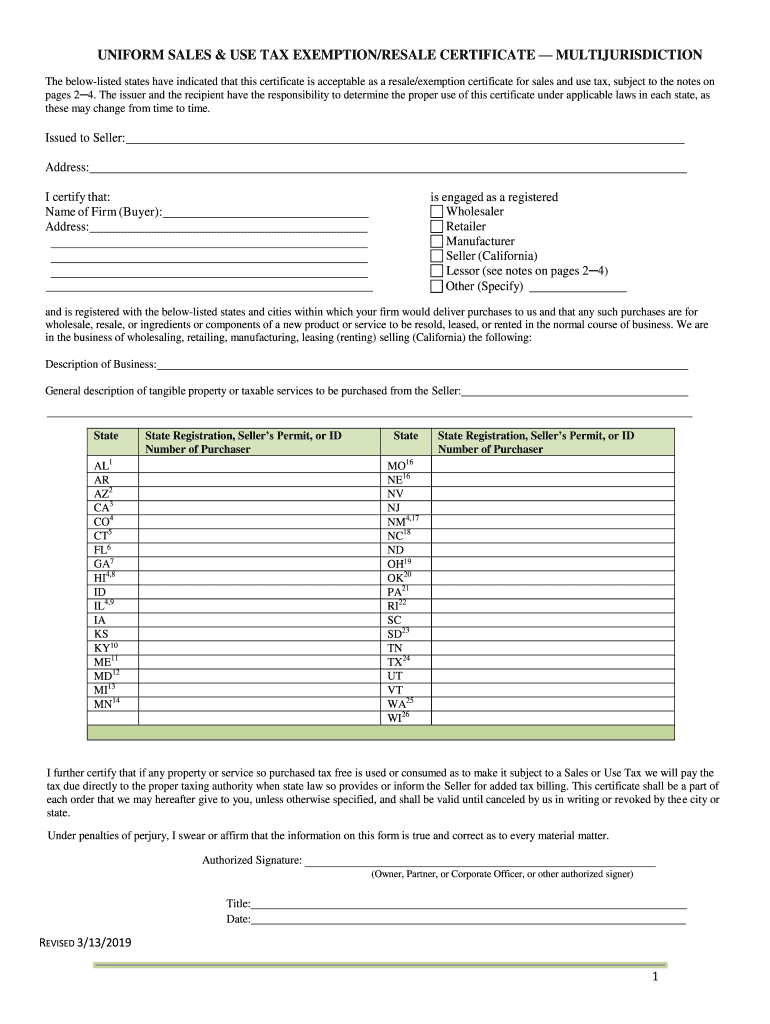

2019 Tax Certificate Fill Out Sign Online Dochub

How To Register For A Sales Tax Permit In North Dakota Taxvalet

North Dakota Sales Tax Application Registration

North Dakota Tax Refund Canada Fill Online Printable Fillable Blank Pdffiller

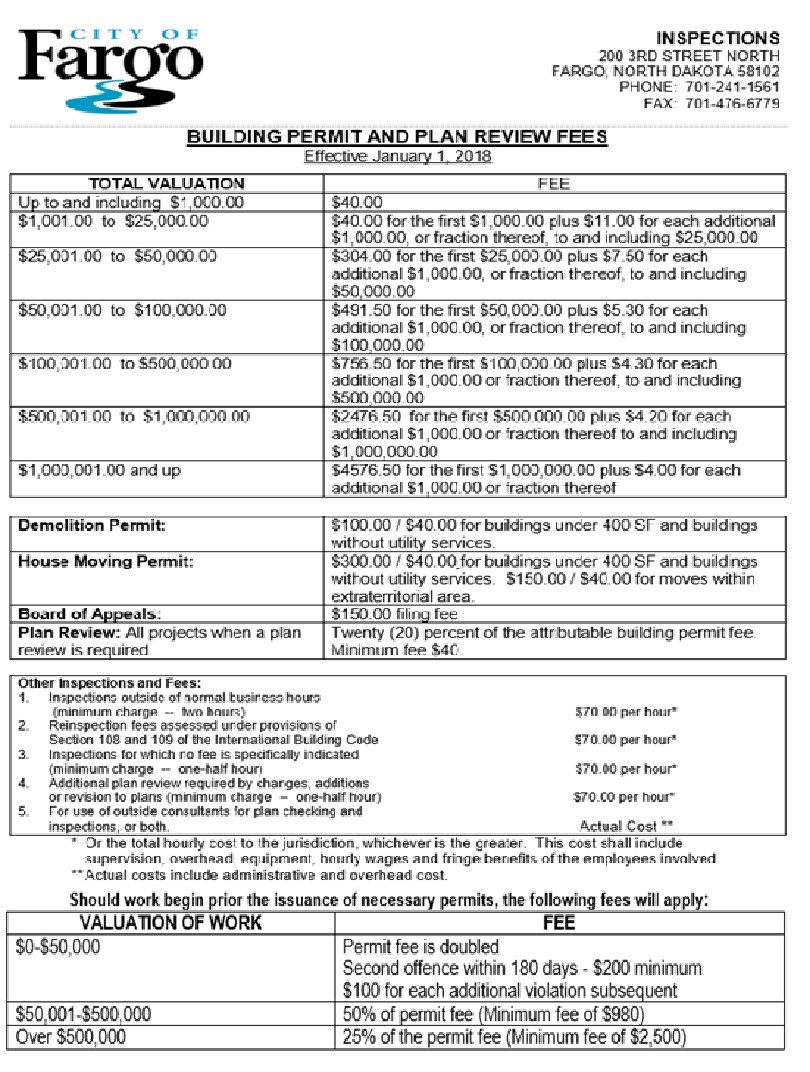

General Contractors License North Dakota Requirements Applying

The Ultimate Guide To Internet Sales Tax

Sd Tax License Dude Walker S Music On Wheels Wedding Dj S Event Production Dude Walker

4 25 Pts Complete The Bid Summary Below For A Chegg Com

Internet Sales Tax Definition Types And Examples Article

How To Register For A Sales Tax Permit In Every State Accuratetax Com

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

Form 59507 Application To Register For Income Tax Withholding And Sales And Use Tax Permit